The South African government’s policy on Russia’s unprovoked invasion of Ukraine comes in the context of its record on human rights internationally, which is a sorry tale. In the pursuit of its own agenda internationally over the past 15 years, the ANC has conflated...

Of super-coalitions and national interests: That which binds the ANC and the DA

South Africa needs a grand coalition between its leading parties South Africans recently voted in the fifth round of local elections of the democratic era, and the results have been widely seen as a tectonic shift in South African politics, with many holding that the...

GGA mourns Prof Ivor Sarakinsky

GGA mourns the passing of Ivor Sarakinsky, an associate professor in the Wits School of Governance (WSG) and a member of the editorial advisory board of The Africa Governance Papers. Professor Sarakinsky passed away on 17 September 2021 due to ill-health. In its...

Making sense of South Africa’s week of anarchy

South Africans find themselves confronted with the ugly spectre of rioting and looting that has claimed over 100 lives, and also dealt a devastating blow to the economy. The situation remains extremely volatile, and while narratives abound, particularly on social media, facts are in short supply. It is important to examine the situation in as level-headed a manner as possible to gain an understanding of what has really befallen our nation.

Editor’s Note: An opportunity to build resilience

As I write, the Covid-19 pandemic is in its fourth month. Measures aimed at combating the virus have devastated economies and strained health-care systems everywhere, especially in the developing world. The pandemic is a huge challenge for humanity, but it might be...

C-19: Africa’s “wicked problem”: An Africa in Fact pandemic blog series

How African governments go about the challenges of dealing with the pandemic will shape the future of the continent for many years. In this Africa in Fact series of blogs, six of our correspondents across the continent will report over the next twelve weeks on aspects of their governments’ policies and actions.

The ancient libraries of Africa

Africa: the written word Africa’s great libraries are stories of state formation and empires, and of people who thirsted for knowledge Reading and writing are miraculous activities; they transform the human condition, making possible new modes of social life. In a...

A long and potholed road: Sustainable stock exchanges

Markets around the world are adopting the environmental, social and good governance agenda, but “integrated reporting” faces problems in Africa By Richard Jurgens In August 2012 police fired on a crowd of striking miners in Marikana, in South Africa’s platinum mining...

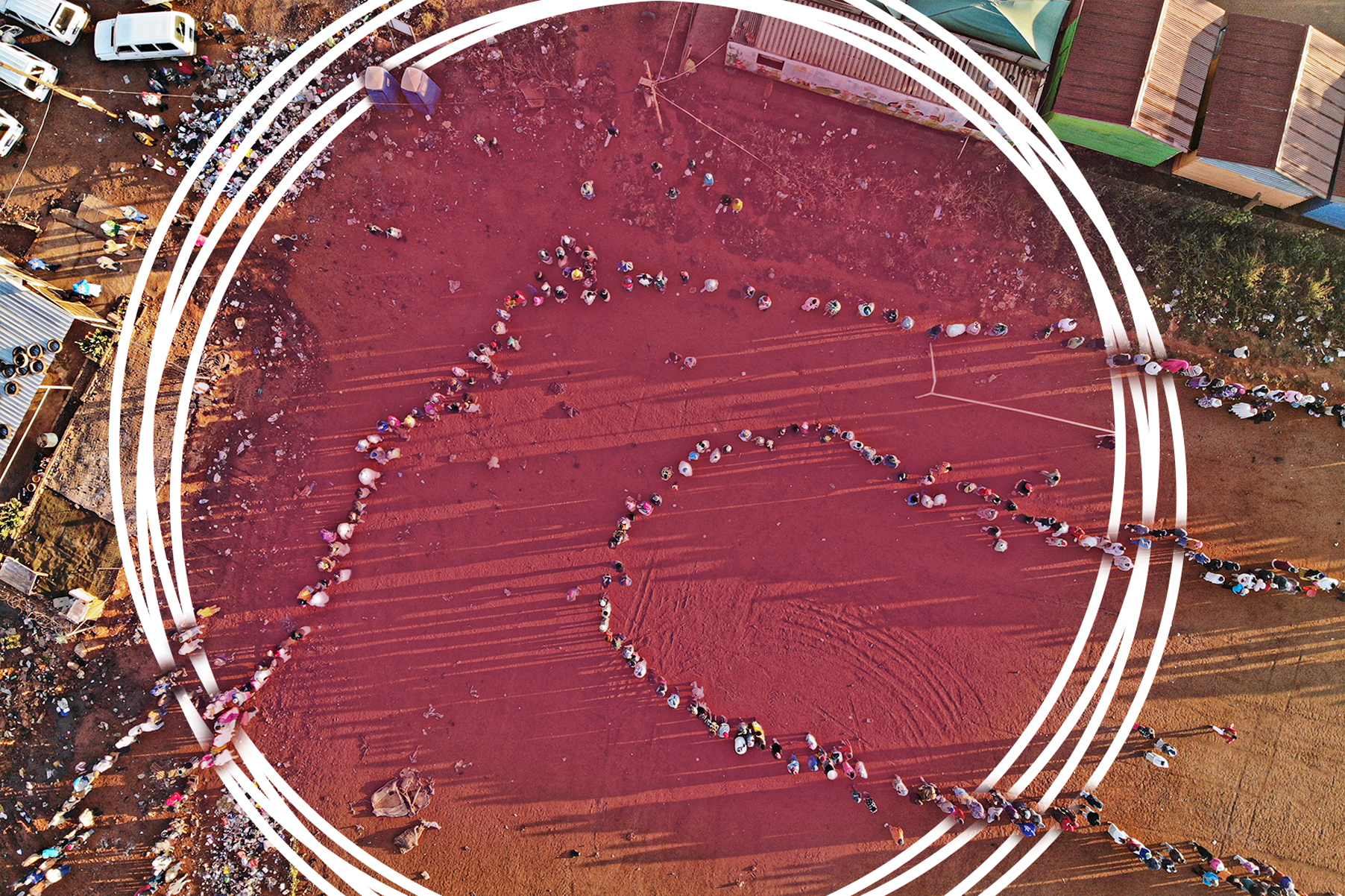

The path out of poverty

SDG 1: poverty Africa will be home to 87% of the world’s poorest people by 2030, but that shocking figure hides the real progress made by some countries By Richard Jurgens, Susan Russell and Charmain Naidoo In 2004, the former Soviet president Mikhail Gorbachev told...

The elusive psychology of Africa’s leaders

There is a notable lack of specifically psychological studies of African leadership Among contemporary black leaders in Africa there is a “widely shared belief … that it is time for Africa to produce leaders with the requisite capacity for high performance and moral...

Russia in Ukraine: South Africa’s unprincipled stance

The South African government’s policy on Russia’s unprovoked invasion of Ukraine comes in the context of its record on human rights internationally, which is a sorry tale. In the pursuit of its own agenda internationally over the past 15 years, the ANC has conflated...

Of super-coalitions and national interests: That which binds the ANC and the DA

South Africa needs a grand coalition between its leading parties South Africans recently voted in the fifth round of local elections of the democratic era, and the results have been widely seen as a tectonic shift in South African politics, with many holding that the...

GGA mourns Prof Ivor Sarakinsky

GGA mourns the passing of Ivor Sarakinsky, an associate professor in the Wits School of Governance (WSG) and a member of the editorial advisory board of The Africa Governance Papers. Professor Sarakinsky passed away on 17 September 2021 due to ill-health. In its...

Making sense of South Africa’s week of anarchy

South Africans find themselves confronted with the ugly spectre of rioting and looting that has claimed over 100 lives, and also dealt a devastating blow to the economy. The situation remains extremely volatile, and while narratives abound, particularly on social media, facts are in short supply. It is important to examine the situation in as level-headed a manner as possible to gain an understanding of what has really befallen our nation.

Editor’s Note: An opportunity to build resilience

As I write, the Covid-19 pandemic is in its fourth month. Measures aimed at combating the virus have devastated economies and strained health-care systems everywhere, especially in the developing world. The pandemic is a huge challenge for humanity, but it might be...

C-19: Africa’s “wicked problem”: An Africa in Fact pandemic blog series

How African governments go about the challenges of dealing with the pandemic will shape the future of the continent for many years. In this Africa in Fact series of blogs, six of our correspondents across the continent will report over the next twelve weeks on aspects of their governments’ policies and actions.

The ancient libraries of Africa

Africa: the written word Africa’s great libraries are stories of state formation and empires, and of people who thirsted for knowledge Reading and writing are miraculous activities; they transform the human condition, making possible new modes of social life. In a...

A long and potholed road: Sustainable stock exchanges

Markets around the world are adopting the environmental, social and good governance agenda, but “integrated reporting” faces problems in Africa By Richard Jurgens In August 2012 police fired on a crowd of striking miners in Marikana, in South Africa’s platinum mining...

The path out of poverty

SDG 1: poverty Africa will be home to 87% of the world’s poorest people by 2030, but that shocking figure hides the real progress made by some countries By Richard Jurgens, Susan Russell and Charmain Naidoo In 2004, the former Soviet president Mikhail Gorbachev told...

The elusive psychology of Africa’s leaders

There is a notable lack of specifically psychological studies of African leadership Among contemporary black leaders in Africa there is a “widely shared belief … that it is time for Africa to produce leaders with the requisite capacity for high performance and moral...