Angola is trying to diversify its economy and reduce its dependency on oil exports

Angola is sub-Saharan Africa’s third largest economy and one of the continent’s leading producers of crude oil. Since the end of its three-decade civil war in 2002, governmental trade missions and private investors have streamed into Luanda seeking lucrative peacetime deals.

Yet Angola has posted negative foreign direct investment (FDI) flows for the past four years, according to the 2015 World Investment Report by the United Nations Conference on Trade and Development (UNCTAD). This is partly a result of the way Angola’s oil industry works: exploration is paid for by parent companies, which recoup their initial investment and additional profits once the oil starts flowing.

Another quirk of FDI into Angola is that the government has used billions of dollars of Chinese money to pay for post-war reconstruction projects such as roads and railways. The money is allocated to Angola in return for oil cargoes, but most of it stays in Beijing, to fund Chinese firms’ delivery of projects in Luanda, according to industry insiders. These big infrastructure deals attract smaller Chinese companies to the country to provide support services, but most of the money is not directly invested into Angola.

Meanwhile, oil accounts for 95% of Angola’s exports and about 45% of GDP, rendering the country vulnerable to downswings in the oil price. The oil price has seen historic lows in recent months, trading in February at just above $30 per barrel. Revenues from oil exports fell by more than 50% in 2015 compared with the year before, according to the Ministry of Finance. Angola’s GDP growth expected to decelerate to 3.8% in 2015 from 4.2% in the year before, according to the African Development Bank (ADB).

Globally, international oil companies are cutting their spending and shedding jobs, including in Angola. In addition, overseas companies are gaining fewer contracts in sectors such as construction and fewer expatriates are living and spending locally.

The sharp drop in government revenues has sent Angola’s currency, the kwanza, into free-fall. It lost nearly 40% of its value between March 2014 and March 2016. By February 2016, inflation soared to a five-year high of just more than 20%. The weakening kwanza has limited what companies can afford to import and also led to a shortage of foreign exchange in local banks, making overseas payments difficult and creating headaches for firms trying to repatriate profits and pay salaries into foreign bank accounts.

In February, South African liquor brands conglomerate Distell, which has enjoyed strong sales in Angola, said it would scale back plans to build a $40m production plant. A few weeks later, dairy products and beverages group Clover, another South African company, also announced it was limiting its expansion plans there.

Many investors now want to limit their exposure to Angola, says Anna Rosenburg, practice leader for sub-Saharan Africa at Frontier Strategy Group, an emerging markets investment advisory firm. “[Companies] are looking at other countries where it is easier to do business, because Angola has always been quite a tricky place to operate,” she told Africa in Fact.

Angola is ranked 181st out of 189 economies surveyed by the World Bank’s 2016 Doing Business report. The report cited the length of time it takes to register property, to get electricity and to access bank credit among the reasons for the poor operating environment. The country’s bad roads and infrastructure, problems in getting entry visas, high business costs, endemic corruption and weak legal system, which makes dispute resolution difficult, also present challenges to doing business.

Skills gaps are another major problem, Septime Martin, ADB resident representative in Angola told Africa in Fact. “The high cost of manpower and lack of skilled and managerial competencies in comparison to the regional standards,” are, he said, key structural challenges for people trying to do business in Angola.

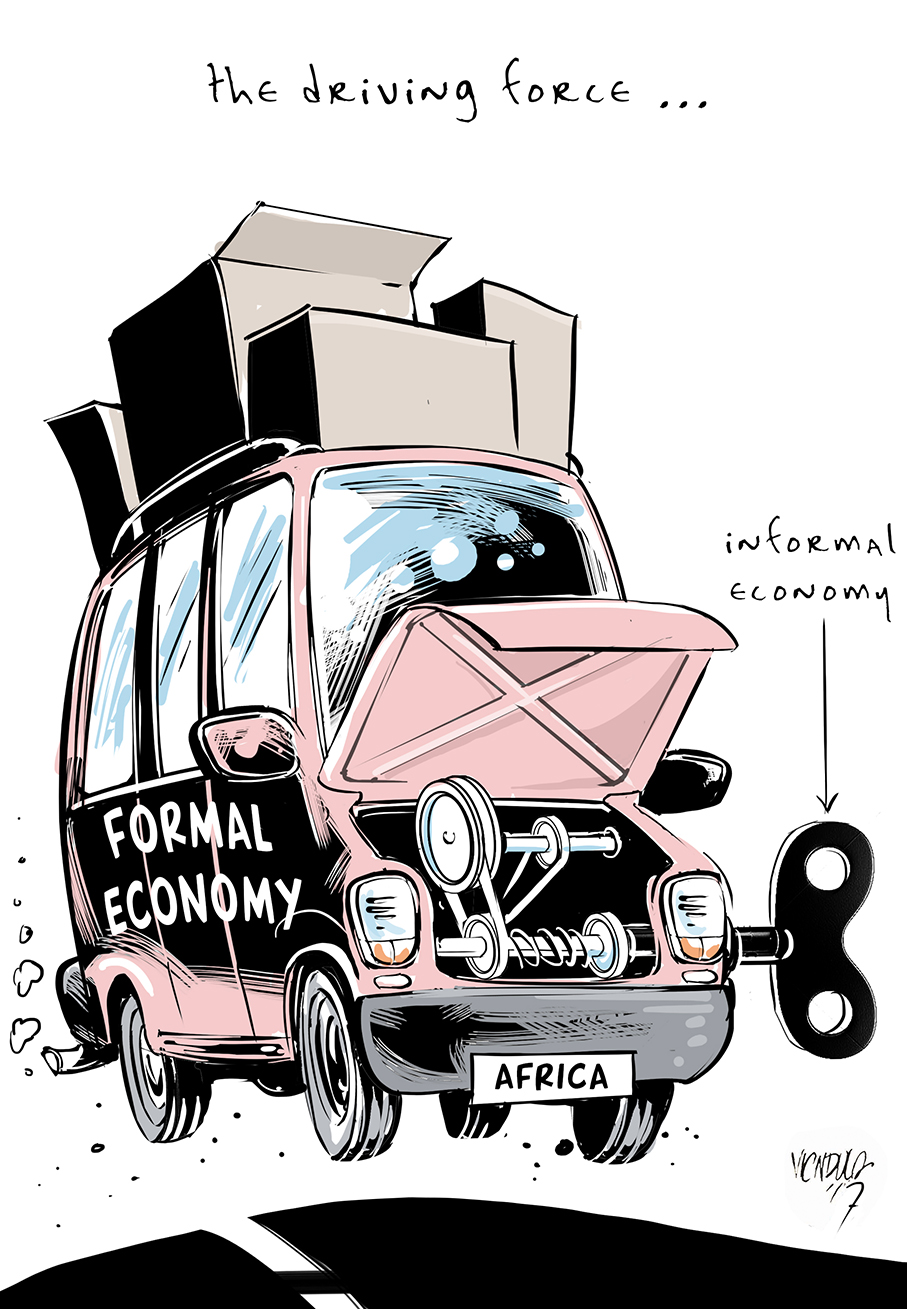

After years of post-independence Marxism, Angola finally embraced free market economics in 1991, but its private sector remains severely under-developed. Its non-oil economy is beset by high prices and low quality because it is dominated by a politically-connected elite. Moreover, incentives to reduce imports are limited because the same small circle of business figures benefits from heavily monopolised supply chains.

The government has pledged to focus on diversifying the economy in an effort to make the country less vulnerable to future oil price shocks. In 2014, it introduced a new customs tariff aimed at reducing imports by protecting local industries and incentivising domestic production. In August last year it passed a new investment law and abolished the Agência Nacional do Investimento Privado (ANIP), which assessed projects.

ANIP was replaced by the Agência para Promoção de Investimentos e Exportações de Angola (APIEX), which will focus on promotion and marketing and leave project assessment to specialised departments within government ministries. Other government-led improvements include lowering the cost of registering a business and a commitment to cracking down on corruption within the civil service.

The government is trying hard to shake off its poor business reputation. “We are a lot more advanced than people imagine and we want to say to the world that Angola is a good country to invest in,” said Norberto Garcia, the director of a newly formed technical unit for private investment (UTIP), on the sidelines of an investment conference in Portugal in late February.

From the potential investor’s point of view, the “biggest change” has been the new investment law’s removal of a minimum $1m requirement for overseas investors, which priced many overseas firms out of the market, says Jorge Nadais, a partner at Deloitte who advises firms on investment projects in Angola. “Smaller businesses and entrepreneurs can now invest,” he said.

Other positives he identified included more transparency around tax exemption eligibility and profit repatriation, and more clarity around rules about whether local partners were required or not.

Between November 2015 and February 2016, Angola received “investment intentions” of more than $5 billion. However, only $186m in projects were approved in that period. It is perhaps too soon to evaluate the full impact of the new investment law, according to officials at APIEX.

“Things are getting better in Angola,” Mr Nadais told Africa in Fact. “In the past the [government] had talked about diversification as something to aim for, but not much happened. Now is it quite urgent, and they are working towards that.”

Ms Rosenburg agrees that Angola’s government is demonstrating “a strong will to make thing easier”. “The plan to diversify is good and things are moving in the right direction,” she said. However, the country was still dependent on imports, and real diversification would require an acceleration of government efforts on several fronts. The current economic situation remained a “big challenge”, in her view—especially Angola’s restricted access to foreign exchange.

Mr Nadais, meanwhile, says that the Angolan government is “very keen” to get new investors on board, and companies interested in domestic production would benefit from legislative protection. For example, food importers could bypass expensive customs tariffs by setting up in-country operations and sourcing and packaging there. However, their long-term cost effectiveness would still depend on access to electricity and the amount of red tape associated with setting up a business.

“As an investor in any market you have to balance the problems, such as poor infrastructure and other risks, with the opportunities,” he said. “If you’ve got the cash and are prepared to make a long-term commitment, there are some excellent opportunities in Angola.”