A view that appears to be gaining traction in some policy circles is that African countries need a benevolent dictator. The argument runs along the lines of suggesting that we’re not quite ready for democracy: Due to...

A view that appears to be gaining traction in some policy circles is that African countries need a benevolent dictator. The argument runs along the lines of suggesting that we’re not quite ready for democracy: Due to...

At the end of June 2023, the International Monetary Fund (IMF) announced Zambia reached a deal with its Official Creditors Committee (OCC) under the G20 Common Framework for debt relief. Under the deal, Zambia will...

Debt relief negotiations are currently taking place, with Zambia expected to be the first country to receive debt relief under the newly created G20 Common Framework. However, the process faces challenges, with China...

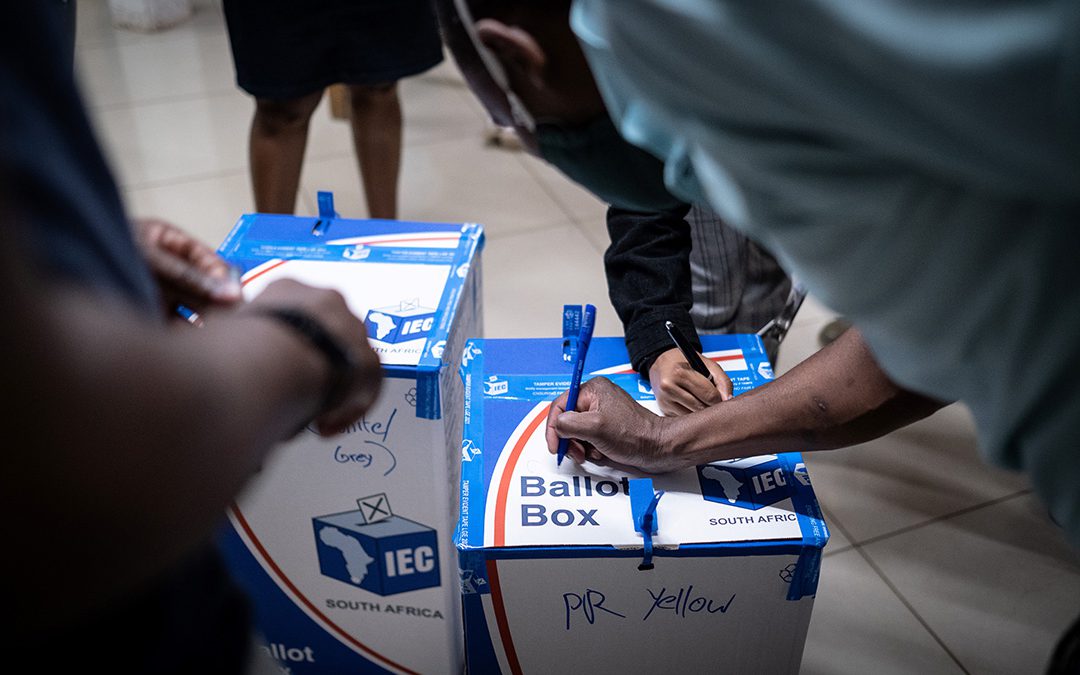

INSIGHT: Addressing the lack of youth representation and utilising platforms like social media could energise young voters and improve overall voter turnout. As South Africa commemorates Youth Day and prepares for the...

The misalignment and miscommunication of South Africa’s foreign policy continue to be the subject of much scrutiny and criticism. The African peace initiative presents South Africa with an opportunity to recalibrate...

Around 50% of Malawians are poor and close to a quarter are unemployed. This has made most people, particularly the young, desperate for money-making opportunities, a situation that traffickers and their agents take...