While other countries’ attitudes towards Africa waver, China is seizing the opportunity to snap up the continent’s mining assets

On 17 January this year, any remaining uncertainty over one of the largest transactions in the mining monopoly in the Democratic Republic of the Congo (DRC) dissipated. The Congolese government dropped its objections to the sale of its $3,8 billion combined stakes in the Tenke Fungurume copper and cobalt operations – by New York Stock Exchange-listed Freeport-McMoRan Inc. and Toronto Stock Exchange-listed Lundin Mining Corporation – to two Chinese companies.

China Molybdenum is listed on both the Hong Kong and the Shanghai stock exchanges. The acquisition makes it a main player in the world’s copper market, along with being one of the world’s largest molybdenum and tungsten producers. Last May it announced a deal with Freeport for the acquisition for $2,65 billion of its 56% interest in the Société Minière de Tenke Fungurume (SMTF) which, in 2016, produced 200,000 tonnes of copper cathodes – one fifth of the DRC’s total output. Chinese private equity fund BHR Partners signed an agreement on 15 November with Lundin Mining for the purchase of its 24% interest in Tenke for $1,14 billion.

The state-owned Congolese company Gécamines, which retains a 20% minority stake in Tenke, had argued that the transactions would not take into account its pre-emption rights over the stake its partners sold. It also demanded the right to authorise changes to indirect ownership of the strategic Tenke Fungurume mine. The objection was lifted after Freeport paid $33 million to the state miner, according to a statement from the Phoenix-based company at the end of January.

Both Chinese partners confirmed Claude Polet, SMTF’s managing director, and other key executives in their positions. This attitude demonstrates an evolution; during the first stage of Chinese investment in the mining sector in the late 1990s traders limited their role to purchasing ore from artisanal miners and exporting to China.

The Tenke Fungurume deal shows that Chinese mining firms continue to consolidate their positions despite the fall in copper prices to $4700/tonne in September 2016, before a rise to $5900/tonne at the end of January 2017; this was still 40% below the 2009 level. Other players, including the Swiss company Glencore, have put their production on hold but Chinese firms have continued to invest massively in the DRC in recent years, the Chamber of Mines of the Federation of Congolese Enterprises said in June 2016.

According to the International Monetary Fund, in 2014 China invested up to $4,33 billion in the DRC in all sectors. China consumes about 40% of the world’s copper and has taken advantage of the falling prices to improve its access to the resource. The country lacks significant copper resources said Jerry Jiao, vice-president of China Minmetals, at the April 2015 world copper conference in Santiago, Chile.

Uncertainty around the DRC’s political future after President Joseph Kabila’s second and last mandate expiring in December 2016 has not deterred Chinese companies’ appetites for minerals in Katanga. In December 2015 Zijin Mining closed a deal with Canadian mining tycoon Robert Friedland’s Toronto Stock Exchange-listed Ivanhoe Mines to buy a 49,5% stake in the mega-deposit of Kamoa. It secured access to a resource of 6,6 million tonnes of copper, or the equivalent of more than six times the current Congolese national output.

In January 2016, Zijin Mining, the Zhejiang Huayou Cobalt Corporation, and Gécamines approved an investment plan of $578 million to develop COMMUS, their joint venture near Kolwezi. Simultaneously, the China Nonferrous Mining Group Corporation (CNMC) agreed with Gécamines to acquire a 49% stake in the Deziwa deposit of five million tonnes of copper and to build two processing plants with a combined production capacity of 95,000 tonnes of copper cathodes. And in August 2016, Gécamines said that CNMC might invest up to $2 billion in the project and increase its share to 51%.

Before these deals, in November 2015, Sicomines, a joint venture between Gécamines and a Chinese consortium including the China Railway Group, Sinohydro and the China National Machinery Engineering Corporation, started producing its first copper as part of a minerals-for-infrastructure mega-deal. According to the agreement signed in 2007 and amended in 2009, the Chinese consortium pledged to build $3 billion worth of roads, railways, hospitals and schools in return for a 68% stake in Sicomines, gaining access to 6,8 million tonnes of copper and 625,000 tonnes of cobalt.

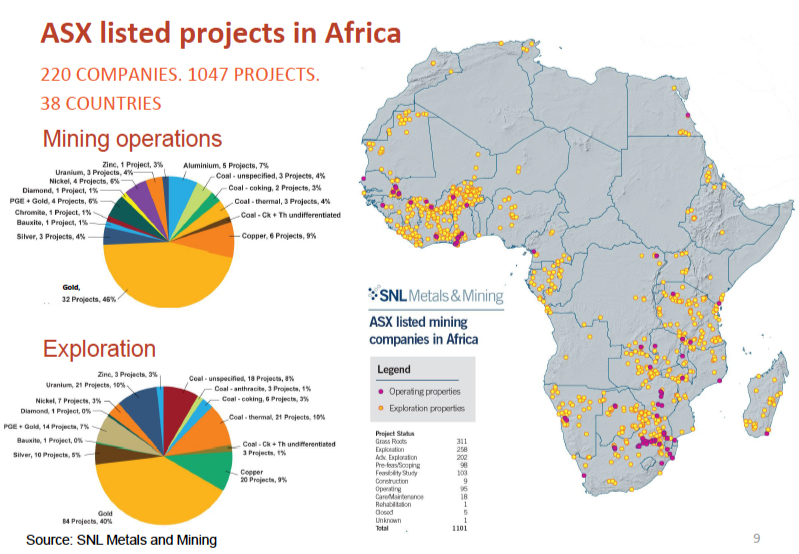

These acquisitions in the DRC are part of a wider global strategy. According to Hongyu Cai, a director with the China International Capital Corporation, Chinese investors are looking for productive assets, rather than greenfield and brownfield projects. Copper, gold and zinc are their priorities. Coal, especially in Mozambique, they leave to Indian, Japanese and Brazilian investors. China is also looking for iron ore for its “New Silk Road” programme, with Nairobi as an African hub. The project, which aims to establish trade axes with Europe and Africa, involves the construction of roads, bridges, ports and railways – which will need large quantities of steel.

China’s dependence on metal imports has grown in recent years, with iron ore a good example, says Magnus Ericsson, CEO of Raw Materials Group. One way it is securing its supplies is by investing in joint ventures in iron ore production abroad, including in Africa.

Aside from siphoning raw materials towards China, the strategy also aims to feed nascent industries focused on the Special Economic Zones (SEZ), a plan Beijing announced at the 2015 Forum on China-Africa Cooperation in Johannesburg. China has already helped to set up SEZs in Zambia, Mauritius, Ethiopia and Nigeria. In January 2017 Wang Yi, China’s minister of foreign affairs, announced his government’s intention to help Congo-Brazzaville build a harbour city at Pointe-Noire.

The purpose is to process the raw materials at the source. This would allow Sino-African companies access to platforms that benefit from the preferential tariffs afforded by trade deals with important markets such as the European Union (EU), within the framework of the EU’s Economic Partnership Agreements with African countries, says Paul Frix, former director general of the Belgian Development Cooperation. The SEZs fit China’s Zou chuqu, or “going out” strategy, which invests surplus capital in foreign markets, natural resources and advanced technology. This strategy runs concurrently with the country’s Yin jinlai, or “welcoming in”, policy, which facilitates foreign investment in China to boost technological advancement and domestic capital formation.

The country’s appetite for copper is not restricted to the DRC. In Uganda, Tibet Hima – a consortium of seven companies (Dongfang Electric, Shanghai Baosteel, Tebian Electric Apparatus, Yunnan Copper, Chinalco Luoyang Copper, Zijin Mining and Zongshen Industrial) – is investing $175 million in the development of the Kilembe copper and cobalt mine, where proven copper reserves are estimated to be between 4,5 and

6 million tonnes. In Namibia, AIM-listed China Africa Resources, a 65% subsidiary of East China Minerals Exploration & Development Bureau, is considering the development of the Berg Aukas project. In the Zambian copper belt, Chinalco Yunnan Copper and Kam Chuen Resources Holding are developing several mines in Solwezi and Chambishi.

Meanwhile, CNMC is expecting its 85%-owned South East Ore Body mine at Chambishi to start producing in 2018, despite the rise in Zambia Electricity Supply Corporation’s tariffs in 2016. In that country, several years of drought have increased power costs. In Congo-Brazzaville, the Congolese subsidiary of the China National Gold Group Corporation appears set to start per annum production of 20,000 tonnes of copper cathodes in 2017, representing a total investment of $250 million, according to the Paris-based Africa Mining Intelligence newsletter.

Simultaneously Chinese companies are rushing for iron deposits. In Conakry, Guinea, Conakry China Alumining Co (Chinalco) signed an agreement in October 2016 to purchase Rio Tinto’s stake in the world-class Simandou South deposit; its reserves represent a potential annual production of 100 million tonnes of ore over 40 years. The project is enormous, with a development cost of approximately $18 billion, and could affect iron ore prices, warned The Australian newspaper in November 2016.

In Cameroon, Sinosteel Cam is expecting to begin production before the end of 2017 at the Kribi mine, where reserves are estimated at 663 million tonnes of iron ore, with a year output of 10 million tonnes.

Guinea’s bauxite deposits are also attracting massive Chinese investments. Winning Shipping Ltd., one of the Asia’s largest maritime companies, holds 40,5% of the Société Minière de Boké, which aims for an annual production capacity of five million tonnes. In October, another Chinese company, Shandong Weiqiao, a leader in aluminium, acquired a 22,5% stake in the same project.

At the beginning of this year talks took place between the Guinea government and Aluminium Corp. China (Chalco) to acquire the Boffa, Santou and Houda deposits. As elsewhere on the continent, the Chinese offer the comparative advantage of being able to propose “all-in” solutions to African countries, including financing and logistics provisions for the project.

Li Wanxing, Chalco’s CEO, has suggested building infrastructure, including roads and a harbour, to evacuate the ore against the exclusivity on these deposits. In early 2016 the China Communications Construction was negotiating with the Côte d’Ivoire

presidency for the construction of a railway and a minerals terminal at San-Pédro harbour. Sinohydro, a stakeholder in Sicomines in Katanga, is rehabilitating the Busanga hydropower dam and is bidding for the construction of the 4,800 MW Inga 3 dam project on the Congo River to provide energy to the DRC’s mining industry.

Chinese investors also covet manganese deposits. In Gabon CITIC Dameng has acquired the Montbeli mine, one of the largest high-grade manganese mines in the world. In

Côte d’Ivoire, the Compagnie minière du littoral, a subsidiary of the China National Geological & Mining Corporation, is exploiting the Lauzoua deposit, some 180 km from Abidjan. It expects to achieve a one million tonne target by the end of 2017.

Chinese companies are also interested in the gold sector. In Ghana, BXC, a subsidiary of the Beijing Fuxing Xiaocheng Electronic Technology Stock Corporation, invested

$15 million in the Kubi gold mine, which it is developing with the Asante Gold Corporation. In Tanzania, the Sichuan Xinye Investment Corporation of Mining & Exploration, a subsidiary of the state-owned Sichuan Bureau of Metallurgical Geology and Exploration, began production in January 2016 at the Ikungu mine, near Lake Victoria.

In Mozambique, a consortium – the Anhui Foreign Economic Construction Group and Yunnin Xinli Non-Ferrous Metals Co. – said it would invest more than $471 million in the development of the Chibuto heavy sands, which have high ilmenite and titanium contents.

Chinese companies are also snapping up major assets in the fertiliser market. Evergreen Holding Group purchased Canadian company Mg Industries’ stake in the Mengo potash deposit in Congo-Brazzaville and plans to develop the project with the financial support of the China Development Bank to produce 1,2 million tonnes per annum.

Hong-Kong based Well Efficient and Kam Lung Investment Development have acquired shares in Eritrea’s first company, Danakali Ltd., which they are developing as a world-class project, flouting the country risk, observes market analysts Somers & Partners.

In Togo the Wengfu Group and Israeli company Elenilto Minerals have obtained the concession for the Kpeme deposit, whose potential is estimated between one and two million tonnes.

Uranium is also in demand; Ansheng Investment, the Jiangsu Huaxing Investment Group and China Growth Minerals are developing the Letlhakane deposit through ASX-listed

A-Cap Resources. Production is expected to start in 2020. President Ian Khama’s younger brother, Anthony, sits on A-Cap’s board.

In Namibia the China National Nuclear Corporation, which already owns a 24% stake in the Langer Heinrich mine – which should start producing this year – is negotiating the purchase of a further 25% interest from the operator, Paladin Energy. In the same country, at the end of 2016 the China General Nuclear Group started production at the large Husab mine and hopes to meet a 6,803 tonne annual target.

Chinese companies are steadily winning influence across the minerals sector in Africa. Their approach includes acquiring assets in existing mines or in greenfield projects through state-owned firms or private firms based in Hong Kong or elsewhere. They are doing this with or without the support of Chinese banks and under a growing variety of formulas. The attitudes of companies from other countries may fluctuate, but the Chinese don’t hesitate.

Francois MIsser is a Brussels-based journalist. He has covered central Africa since 1981 and European-African relations since 1984 for the BBC, Afrique Asie magazine, African Energy, the Italian monthly magazine Nigrizia, and Germany’s Die Tageszeitung newspaper. He has written books on Rwanda and the DRC. His last book, on the Congo River dams, is La Saga d’Inga