In the wake of South Africa cementing itself as a coalition nation — through forming a government of national unity — attention is focused on re-elected President Cyril Ramaphosa to announce a new cabinet. The new ministers will pick up from where the sixth democratic administration left off.

One of the key ministerial announcements will be in the Department of Mineral Resources and Energy, currently under Gwede Mantashe. This is especially the case because of the need for an expedited, just energy transition and the April release of the draft Gas Master Plan (GMP) for public comment.

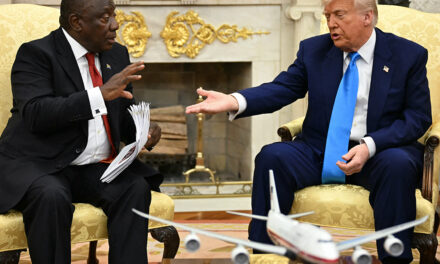

Photo: IGUA-SA

The GMP establishes how South Africa should effectively meet its energy needs and simultaneously realise a just energy transition.

The release of the plan comes at a time when prior warnings of gas supply shortages will become a reality in June 2026, after Sasol’s announcement that it will stop supplying natural gas from Mozambique due to the termination of the contract.

The GMP is designed to complement existing energy policies and contribute to an integrated energy planning approach for the country as outlined in the updated Integrated Resources Plan. It provides a framework for the role of natural gas in the energy mix and gives policy direction to industry.

As such, its objectives are to:

Ensure that gas supply is secured by diversifying supply options from local and international markets. This is to be achieved while minimising total supply costs and foreign currency exposure.

Facilitate an efficient, competitive and responsive energy infrastructure network such as gas storage facilities, liquefied natural gas import facilities, pipeline networks and regasification plants. Through this, it would also enhance localisation, create jobs and enable economic growth.

Identify strategic partners in the Southern African Development Community (SADC) to unlock local and regional gas demand.

Ensure environmental assets and natural resources are protected and continually enhanced by cleaner energy technologies.

Determine resilient gas infrastructure options in lieu of demand uncertainties and the possibility of a transition to cleaner fuels.

Within this context, relevant stakeholders, members of the public and industry experts were invited to submit commentary on the draft and interrogate whether the plan constitutes a practicable contribution to addressing the immediate challenge of the decline in gas supply.

Industry bodies, such as the Industrial Gas Users Association of Southern Africa (IGUA-SA), have raised concerns about a shortage in gas supply and the negative impact it will have on businesses.

According to IGUA-SA, if they can’t get gas, businesses will need to switch to fuels that are environmentally damaging and more expensive. This will result in raised prices for consumers and an increase in carbon emissions.

These concerns further spotlight the potential job losses that have been outlined by IGUA-SA and other relevant industry bodies, such as Business Leadership South Africa.

One of the key objectives of the GMP is to unlock local and regional gas demand. This paves the way to strengthening regional cooperation and competition through the Southern African Power Pool (SAPP), for instance.

SAPP is the cooperation of the national electricity companies in Southern Africa that represents 12 member states throughout SADC.

SAPP plays a critical role in securing energy supply for the region. Building the organisation within a consolidated gas master plan requires strengthening transmission infrastructure with high-voltage lines in Mozambique through the development of the north-south transmission infrastructure.

As it stands, gas reserves are predominantly found in Angola, Tanzania, Mozambique and South Africa. More recently, natural gas exploration has been underway in Namibia, with two smaller fields discovered offshore.

With gas used for power generation and manufacturing of products, such as plastic, in addition to cooking and heating, the region is in a favourable position to revisit phase one of the SADC regional gas master plan and use updated domestic gas master plans, such as South Africa’s, to take full advantage of commercially exploitable quantities in the SADC region.

In the context of a looming gas shortage in South Africa, the development of the regional plan is ready to progress to phase two. In doing so, the below key components will need to be considered and applied appropriately.

To materialise, the SADC master plan on natural gas markets requires a coordinated approach that prioritises infrastructure development—both existing and new market routes.

Specifically, it needs a roadmap to broaden transport corridors, ports and gas pipe networks.

Infrastructure development can strategically yield significant regional integration and interconnectedness.

This is because infrastructure capacity can connect supply and demand categories for natural gas, industrial users, the transport sector and power generation, which will ultimately contribute to the development of SADC economies.

While there are different infrastructural requirements for the abovementioned categories, leveraging existing infrastructure will enable resourceful use of assets and limit unnecessary capital allocation.

For instance, re-gasified liquid natural gas, transported via the existing Republic of Mozambique Pipeline Investments Company-Mozambique to Secunda Pipeline is reportedly a viable alternative for energy supply for South African industrial users.

In addressing the gas supply shortage, the pipeline will potentially connect liquified natural gas (LNG) from Mozambique’s Matola terminal to South Africa. The terminal is being developed by Beluluane Gas Company, a joint venture between Gigajoule, a South African energy company, and TotalEnergies, a French oil multinational company.

The Matola terminal will have a floating storage and regasification unit that can receive LNG shipments from various sources and deliver regasified gas to a gas-to-power plant to be built at the Beluluane industrial complex.

The terminal is reportedly expected to start operating by mid-2026 and have a capacity of two million tonnes of LNG per year.

This terminal development would ideally fall squarely around the time of Sasol’s existing contract with Mozambique ending.

Looking closely at transport corridors, SADC is regarded as having the most successful corridors on the continent. This is probably due to similar road and rail designs, cooperation among member states, and the establishment of corridor-specific secretariats.

These successes have been enabled by the development of the 2012 Regional Infrastructure Development Master Plan.

While there is great progress and a roadmap has been established for road and infrastructure development—possibly for gas transportation—negative aspects are associated with road infrastructure.

These include a high rate of transport-related accidents, congestion, quality degradation and environmental damage.

Inclusive stakeholder engagement should be central to implementing any master plan that aims to enable optimal energy supply and security.

As policy processes prescribe, public commentary is designed to enable maximum participation to further strengthen the GMP.

Regionally, to leverage economic corridors that maximise regional integration and trade, formal regional clusters and cooperation modalities are to be established.

This requires strategic planning between all stakeholders and further strengthening of corridor management groups.

This article first appeared in the Mail & Guardian.

Busisipho Siyobi is the Programme Head of the Natural Resource Governance Programme at GGA. Prior to joining GGA, she headed up the Corporate Intelligence Monitor desk at S-RM Intelligence and Risk Consulting. Busisipho holds an MPhil in Public Policy and Administration from the University of Cape Town with a research focus on CSR within the South African mining industry. During her Masters, she worked as a research scholar at the South African Institute of International Affairs.